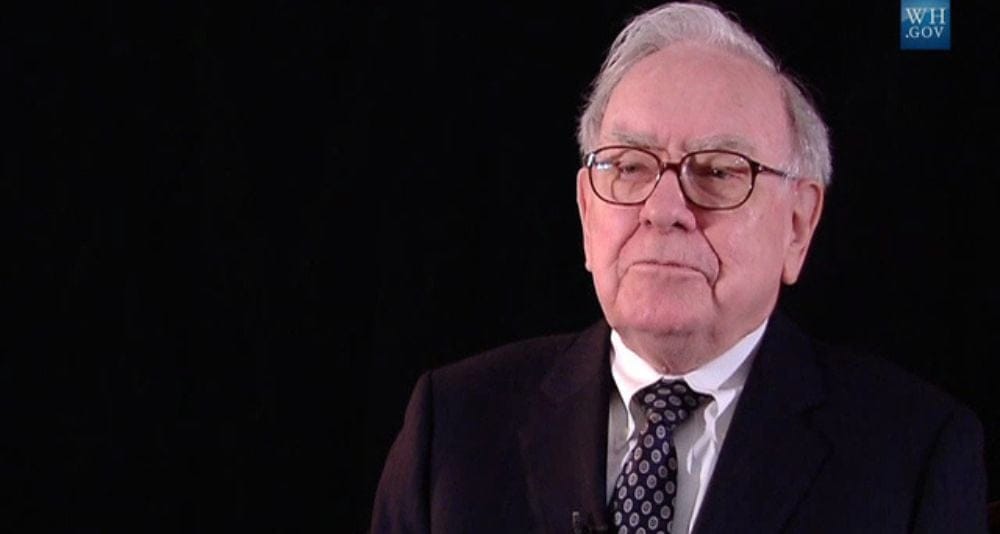

The Oracle of Omaha, Warren Buffett, has made some stock moves this year that have many economists warning that he could be preparing for an impending recession. Warren Buffett’s firm has been selling oodles of stock this year in favor of shoring up some serious cash.

Are these moves merely a way to buffer for increased insurance costs, or are they in preparation to bail out institutions that will be hit hard by a recession? Something else? Mr. Buffett is well known for taking advantage of rocky financial waters, so experts have always kept a close eye on his money moves.

Acting as a crystal ball for the future, the strategic decisions made by Mr. Buffett have proven insightful on what lies ahead. It’s time to look at the tea leaves and face the cold, hard possibility that a recession could be coming.

Sell!

Warren Buffett’s firm, Berkshire Hathaway, sold a large amount of stocks in 2023. In the first quarter, they sold $10.4 billion; in the second quarter, they sold $13 billion and bought less than $5 billion; and in the third quarter, they sold $5.3 billion of stock.

Total for the first three quarters that puts a sale of $28.7 billion worth of stock offloaded into cold hard cash for Mr. Buffett’s firm.

Professor of Applied Economics at Johns Hopkins University Steve Hanke explains what he thinks this means:

“Recent lightening up on stocks and accumulation of a pile of cash – $157 billion – is consistent with the fact that stocks are relatively pricey right now.”

Yes, pricey right now. The kicker, though, is what Mr. Hanke believes these moves by Mr. Buffett indicate:

“…a recession is right around the corner.”

But the professor points out that you don’t have to wager your bets on a recession solely on the decisions made by Mr. Buffett; you just need to be a student of economic history.

He explains the Federal Reserve’s interest rate hikes are the tell:

“The money supply of the United States, broadly measured, started contracting in July 2022, and has been falling like a stone.”

RELATED: It’s A Bidenomics Christmas: Toy Maker Hasbro Announces 1,100 Layoffs In Poor Economy

Similar contractions have happened in four distinct periods of American history to his reckoning, all of which were preceded by massive amounts of money printing: 1920 – 1921, 1929 – 1933, 1937 – 1938, and 1948 – 1949.

Think of those time frames. Before each, respectively, came World War I, the Roaring 20’s, the first half of the Great Depression, and World War II.

The professor points out that:

“Each of these four period was followed by a serious recession.”

Try telling that to anyone in the White House.

This is fine; everything is fine

This month, the Federal Reserve Chair Jerome Powell said:

“There’s little basis for thinking that the economy is in a recession now.”

Mr. Powell is still hopeful for what he calls a “soft landing,” and the Biden administration is also holding onto that dream. It was just last month that President Joe Biden touted the effectiveness of ‘Bidenomics’ in attempting to exude positivity:

“I never believed we would need a recession to bring inflation down.”

RELATED: White House Fact-Checked For Falsely Claiming to ‘Lower Costs’ For the American People

A quick perusal of the White House X account will show almost daily posts claiming that the cost of living for Americans has improved and that the state of the economy is good thanks to Team Biden-Harris. However, Americans aren’t feeling the vibe the Biden administration is trying to sell them.

A recent Bankrate survey found that 59% of Americans feel the economy is currently in a recession. Another Bankrate survey from earlier this year found that 50% of Americans feel their overall financial situation has declined since Joe Biden took office.

Why the disconnect from the claimed reality of the White House and the impression of the American people?

A question of measurements

The White House would like the American people to believe that the feelings they have about their financial status and the economy are merely just that, feelings not based in reality but manipulated by social media, skewed news coverage, and, of course, the Republican Party. However, the real reason behind this disconnect isn’t that the average American is easily duped, but because of their lived experience.

Bankrate analyst Sarah Foster explains:

“Americans seem to be evaluating the economy with different metrics than experts. While economists are watching carefully for broad-based declines in growth, households focus on whether they can afford their needs and the occasional wants while still having enough money left over to put toward key financial goals like saving for emergencies and retirement.”

Imagine that? Americans feel like the economy is in bad shape when they are worried they can’t afford groceries and household bills let alone save for a rainy day or the future. These things are more important to them than the stock price of a company they’ve never heard and can’t afford to purchase anyway.

Ms. Foster punctuates the point with the following:

“Americans judge the economy’s strength by their own individual experiences living within it, and nationwide numbers often don’t tell the same story as their finances.”

While the Biden White House continues to push fake economic optimism in the hopes it secures a second term, everyday Americans are forced to make ends meet at best and continue into financial distress at worst. The economy is serving up some weak tea, and the leaves left behind paint a picture of recession.

Now is the time to support and share the sources you trust.

The Political Insider ranks #3 on Feedspot’s “100 Best Political Blogs and Websites.”