News of the IRS gaining tens of billions and tens of thousands of new agents sent a shiver down the spine of regular Americans after President Biden was able to secure a victory through the passage of the “Inflation Reduction Act.”

Tens of thousands of new IRS agents will be added to the tax collection and enforcement agency in order to ensure even stricter compliance with US tax laws.

Quickly, the battle lines were drawn in the realm of public opinion as Republicans began to speak out against Biden’s “IRS Army” and Democrats sought to counter those claims with accusations of “fear mongering” and election year scare tactics being used right before the upcoming midterms.

Like usual though, the Democrats don’t need to do their own public relations when the mainstream media is just as happy to do it for them.

Abolish the IRS.

— Senator Ted Cruz (@SenTedCruz) August 21, 2022

RELATED: Democrats’ Inflation Reduction Act Is Going To Unleash An Army Of 80,000 New IRS Agents

The Media Shielding Criticism of Biden’s IRS Surge

On Saturday, MSNBC anchor Alex Witt asked Rep. Mike Quigley (D-IL) how Democrats can “cut through the fear mongering” in order to “get the truth out there.”

“Here’s something a number of Republicans have been trying to do,” said Quigley. “Convince Americans that the money that’s been allocated to the IRS in this bill allows the agency to now hire 87,000 new employees, and those new agents will audit middle-class taxpayers.”

Witt ran with Quigley’s talking point and continued to assert that Republican criticisms of the situation were completely false, then tossed the softball question back to the representative asking, “How do you cut through this fear mongering and put the truth out there?”

Quigley quickly jumped into scaremongering of his own by creating an “us vs. them” argument.

“This will allow the IRS to audit the wealthiest corporations and Americans. And these aren’t patriots, what they’re auditing is people who are often tax cheats, who are creating about two-thirds of $1,000,000,000,000 a year in a tax gap.” He continued saying, “if you love this country, one of the things you do is pay your fair share.”

Reuters also jumped into the mix by fact-checking Republican claims that the IRS would be increasing the number of audits on middle and working class Americans, saying that the claims lacked “key context,” stating that “Treasury reps have repeatedly said audit scrutiny would not increase relative to recent years for those making less than $400,000.”

Of course, that’s not a “fact check.” That’s merely repeating what government officials proclaim to be the truth.

That should make you feel better, right? It’s always calming when the watchdogs of government cite government talking points as absolute truth. But the media defense of the IRS expansion didn’t stop there because when in doubt, just go see what trusted, veteran journalist and advocate for the people Dan Rather has to say.

You know what scares unscrupulous rich people more than taxes? An emboldened IRS with enough resources to catch big-time tax cheats. All this fear mongering is a smokescreen to protect those who refuse to pay their fair share.

— Dan Rather (@DanRather) August 21, 2022

“You know what scares unscrupulous rich people more than taxes? An emboldened IRS with enough resources to catch big-time tax cheats,” tweeted Rather. “All this fear mongering is a smokescreen to protect those who refuse to pay their fair share.”

Yes, Dan. The thousands of American citizens and hundreds of conservative non-profit groups who were intentionally targeted by the IRS during the Obama Administration were all “big-time tax cheats.”

RELATED: IRS Job Posting Seeks Special Agents Willing To Carry a Firearm, Use Deadly Force

What Conservatives Are Actually Warning About

From Richard Nixon to Barack Obama, the IRS has time and time again been used as a tool in order to punish one’s political opponents. Republicans, while obviously seeing this as a rallying cry opportunity right before a contentious midterm election, are accurately are calling this out as not only a threat to individual freedoms of speech and association, but as a feeble attempt to cover larger problems within our government.

“What’s most offensive about legislation that has nothing [to] do with inflation is the plan to hire 80,000 new employees for the Internal Revenue Services (IRS)” said John Tamny from the conservative advocacy group, FreedomWorks, in a recent op-ed. “About what’s offensive, this is not an attack on the IRS. The latter is merely an outsourced function of Congress. Since politicians would never themselves want to be directly tied to the odious act of tax collection and harassment, those who do ‘politics’ for a living have hired others to do their dirty work for them.”

Recently, Rep. Matt Gaetz (R-FL) drew attention to a disturbing report that showed that the IRS had since the beginning of 2022 purchased $750,000 worth of ammunition.

“I’m not against stockpiling ammunition,” said Gaetz, “but you shouldn’t have to be a D.C. accountant to do it; you ought to be a mechanic in Pensacola.”

Biden wants to disarm Americans & arm the IRS. In this year alone, the Biden IRS has stockpiled $725K+ in ammo as Americans face a shortage. Why is Biden trying to weaponize the IRS? This is why I cosponsored the "Disarm the IRS Act," to prohibit the IRS from purchasing ammo.

— Rep. Jeff Duncan (@RepJeffDuncan) July 7, 2022

A 2020 report from OpenTheBooks.com titled “The Militarization of the U.S. Executive Agencies” pointed out at the time that the IRS had “2,259 special agents, the spending of $21.3 million on guns, ammunition and military-style equipment between fiscal years 2006 and 2019, which included a stockpile of more than 4,500 guns.”

RELATED: After Inflation Reduction Act Passes, CBS Reports It May Not Reduce Inflation

Why This Should Concern Everyone, Not Just The 1%

While the Democrats are attempting to make it seem like they are only interested in the wealthiest Americans and giant corporations, Republicans are continuing to warn that the burden of taxes will still fall on those with the least amount of protections from the IRS.

In an interview with Fox News‘ Sean Hannity, Texas Senator Ted Cruz warned that the large increase in IRS agents “are not there to go after the billionaires or the giant corporations they are there to go after you. They’re going after small businesses. They are there to descend upon middle-class workers and audit the hell out of you.”

While there’s some hyperbole there, it doesn’t take a genius to figure out that the IRS doesn’t need 80,000 agents for just 1% of the population.

The non-partisan libertarian non-profit Cato Institute echoed that sentiment in an article last year criticizing the Biden administration’s attempts to grow the IRS with his proposed Build Back Better Act.

“More aggressive IRS enforcement would mean more paperwork, more lawyer fees, and more anguish for many law-abiding taxpayers,” said Cato’s Chris Edwards. “It could also threaten our financial privacy and security.”

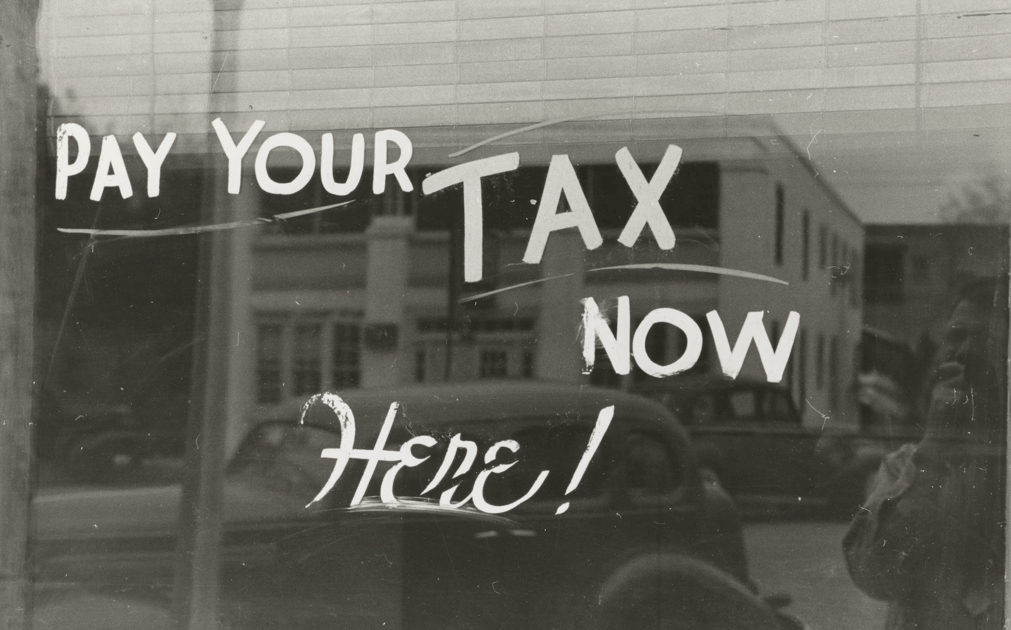

When the IRS was founded, the federal government promised us that it would only be “the rich” who would be getting taxed.

Decades later, look where we are…

DC promises us the IRS’ 87,000 new agents won’t be used against “the people”, but history has a way of repeating itself.

— Libertarian Party (@LPNational) August 22, 2022

Edwards warned that the more aggressive attempts to go after the wealthiest Americans would backfire and cause “collateral damage” to the rest of us.

“If we wanted to cut cheating to zero through enforcement, we could hire an army of IRS agents to routinely search every home in the nation and impose root-canal audits on everyone,” Edwards continued. “But a free people do not want such government intrusion, and so every democratic country has a ‘tax gap’ between what is owed and what is paid.”

As renowned economist Milton Friedman once said, “Judge public policies by their results, not their intentions.”

[totalpoll id=”257979″]

Republicans are right to question the merit of not just the Inflation Reduction Act (which won’t reduce inflation), but of any additional policies that attempt to punish taxpayers and diminish the American standard of living because of the actions of politicians.

Now is the time to support and share the sources you trust.

The Political Insider ranks #3 on Feedspot’s “100 Best Political Blogs and Websites.”