You have to give the left-wing movement some credit; where they first don’t succeed, they will repackage their agenda in a new acronym and try again.

This time the woke warriors utilize ESG (Environmental, Social, and Governance) to push their priorities onto the American people.

Where will Americans unwittingly feel this push? In their retirement accounts, right around the time 401(k)s are taking a hit thanks to Bidenflation.

What It Is

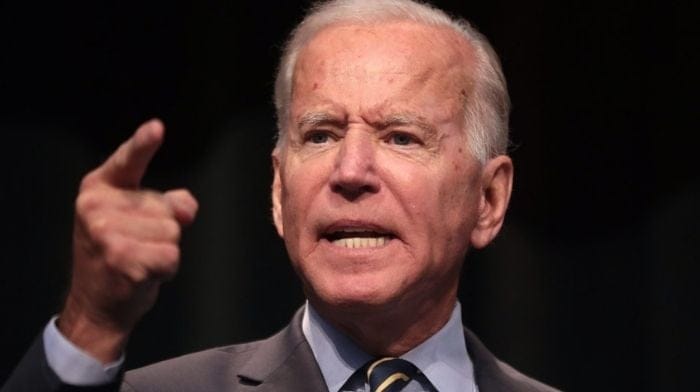

President Biden’s Department of Labor (DOL) is attempting to push ESG directives onto retirement savings programs.

In typical Biden administration form, this is a two-fold strategy. First, to undo a Trump administration rule, and second, to push the social justice team’s goal to reshape what it means to be American.

In short: a Trump Labor Department rule required retirement plan fiduciaries to always act “solely in the interest” of the plan participants.

Meaning: they are to focus solely and only on moves that bring a return to investors.

This rule didn’t eliminate the consideration of ESG components. Instead, it prevented pension plans and asset managers from considering them unless they had a “material effect on the return and risk of an investment.”

So basically, it had to have a definitive chance to earn you the most money or bang for your buck.

So ESG is basically a wokeness social credit score

and you gain points by doing things that will destroy your company if the public finds out about it

— The Virginia Project (@ProjectVirginia) May 24, 2022

This new rule would undo that concept. It goes so far as to state that a fiduciary’s duty may:

“Often require an evaluation of the effect of climate change and/or government policy changes.”

The claim is that things like climate change and other ESG factors are material – in other words, progressive premises and policies are assumed to be a given.

RELATED: EPA Spent $5.3M In Covid Aid On ‘Environmental Justice’ Programming

The Break-up Between the Democrats and Elon Musk

Earlier this month, the Dow Jones Indices announced the removal of Tesla from the S&P 500 ESG index. However, Exxon Mobil was ranked among the Top 10 on the list.

Let that sink in for a minute. The company that undeniably leads the way in electric vehicle production, innovation, and affordability didn’t make the ESG index, but one of the world’s largest oil and gas corporations did. I wonder why?

Margaret Dorn, head of ESG Indices at S&P Dow Jones, explained:

“While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens.”

Elon Musk, who has never been shy to express his feelings, tweeted, among other things:

“ESG is a scam. It has been weaponized by phony social justice warriors.”

.@SPGlobalRatings has lost their integrity

— Elon Musk (@elonmusk) May 18, 2022

So how much wider of a lens is ESG if Tesla doesn’t make the list? They didn’t make the list because of alleged racial discrimination and poor working conditions.

For the record, I’d work for Tesla in a heartbeat. If Elon needs a sarcastic wordsmith, I will work whatever hours he wants.

So basically, Tesla gets a slight nod from ESG for being good environmentally and creating many jobs. However, they just aren’t good at that other pesky three-letter acronym…DEI (Diversity Equity and Inclusion).

RELATED: US Spirals Toward Lawless Carnage; BLM and Woke Corporations Silent

ESG Is Coming For Your State, Too

It’s not just your retirement accounts and poor Elon that ESG is coming for. It’s also starting to creep into how states rate, affecting their credit ratings and therefore money for roads, special projects, etc.

Utah got hit with a ‘moderately negative’ ESG rating because they are experiencing a drought. Never mind the fact that Utah is one of the best at paying back its debts and balancing its budget on a regular credit scale.

.@SenDanSullivan has introduced legislation to rein in the power over corporations enjoyed by the biggest asset managers, many of whom have provoked Republicans by embracing ESG standards for businesses.

— Washington Examiner (@dcexaminer) May 24, 2022

Idaho also got hit and hit back. Idaho Treasurer Julie Ellsworth told Fox Business:

“The ESG rating methodology that S&P has implemented to ‘provide additional disclosure and transparency’ when evaluating credit worthiness appears to be nothing more than a subjective way to penalize Idaho and other states for their political priorities.”

Again, President Biden and his left-wing bedfellows are doing a great job unifying Republican state leaders to fight against their terrible social justice objectives.

A Tool To Reshape America In A New Image?

President Trump told us during the campaign that gas prices would rise under a Biden administration and that their great answer would be to get rid of our cars or buy a $50,000 electric car. Unfortunately, he doesn’t seem to be wrong.

Glenn Beck thinks that ESG is a tool to manipulate the economy to force Americans and businesses to adapt climate initiatives within the Green New Deal.

The World Economic Forum's Annual Meeting starts on Sunday, and plenty of Democrats AND REPUBLICANS will be in attendance! But I'm told by people in Washington that nobody really knows about the Great Reset or ESG…How weird, because YOU'RE ALL THERE. pic.twitter.com/rN9aWtoDfw

— Glenn Beck (@glennbeck) May 20, 2022

Others argue that ESG is just the Chinese social credit system dressed up in a three-letter acronym. For example, Justin Haskins, Director of the Socialism Research Center, argues:

“The point of it (ESG) is to transform all of society, not just to transform what happens inside the walls of some big corporation.”

Conspiracy theory? Or reality? Haskins goes on to state:

“I don’t believe that ESG scores are really being used for the reason that they say they are. I think it’s mostly about controlling society…and about pushing a left-wing agenda.”

Because ESG is subjective to the person or group administering judgment, it’s hard not to think that this is just another tool of the left. Is it one that will be used against citizens?

RELATED: Is Trump A Modern Day Nostradamus? Watch His Prediction Of What Would Happen If Biden Won

Welcome to The New America?

China introduced in 2014 a social credit system. This system monitors individuals, government organizations, and companies. However, China isn’t so concerned with its citizen’s efforts to eliminate carbon emissions and accept gender ideology while admitting to their citizen’s inherent white guilt.

Their social credit system monitors the values of their elites. Ours will monitor the values of our elites.

I would argue that ESG is already trying to creep its way into rating citizens. If the DOL gets its way and can adjust how our retirement accounts are managed without us having a say, then I think that’s probably a clear first step.

What is more personal than our retirement accounts?

It’s time to admit ESG is simply a social credit system. https://t.co/uNpCGRqbNx

— Warren Davidson (@WarrenDavidson) May 19, 2022

For now, the DOL is in a holding pattern awaiting results of what they called a ‘Request for Information on Possible Agency Actions to Protect Life Savings and Pensions from Threats of Climate-Related Financial Risk.’ Whatever that all means.

They tried to get ya with the DEI, the CRT, the SEL, now welcome to their new weapon… ESG.

Now is the time to support and share the sources you trust.

The Political Insider ranks #3 on Feedspot’s “100 Best Political Blogs and Websites.”