Consumer prices in June jumped to their highest point since 2008, an escalation that could indicate inflation will soar higher and endure longer than the White House had been hoping for.

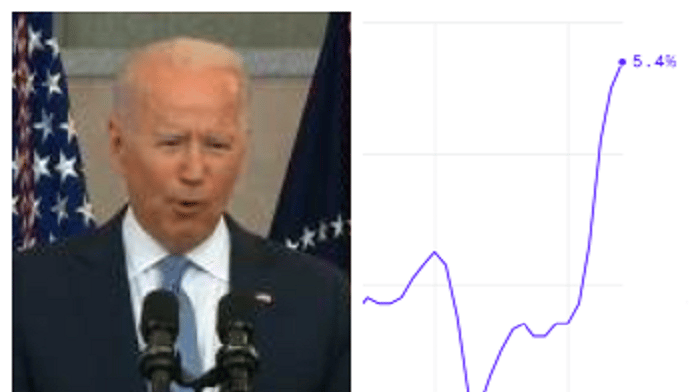

According to CNBC, consumer prices “zoom[ed] up” at a 5.4% annual rate in June based on new data from the Labor Department, surpassing expectations from experts who had been expecting a 5% gain.

Core inflation, stripping out food and energy, rose 4.5%, the highest jump since 1991.

Additionally, 48% of small businesses have raised prices, the largest percentage in 40 years.

What does that mean to the average American?

Because prices are rising at the highest pace in decades, real wages are going down. On an annual basis, real average hourly earnings decreased by 1.7%, and real average weekly earnings fell 1.4%.

CNBC: Rising prices “zooming up” more than expected pic.twitter.com/8Xq7Og6RQR

— RNC Research (@RNCResearch) July 13, 2021

RELATED: Kamala Harris Praises ‘Courage’ Of Texas Democrats Who Fled State On Private Jets

Inflation Here To Stay?

The numbers are a nightmare for the Biden administration which seemingly had an infallible, ironclad economic recovery set up for them as the President entered office in January and businesses began re-opening following the pandemic.

They have been denying that inflation will be a long-term concern, with Politico indicating that the White House has been “saying prices will ease later this year, a view shared by Fed Chair Jerome Powell.”

“The White House was counting on fleeting inflation,” Axios reports to the contrary. “Now, it’s starting to look like it could last.”

Sarah House, a senior economist for Wells Fargo’s corporate and investment bank, tells CNBC that inflation looks stronger than the administration is willing to concede.

“What this really shows is inflation pressures remain more acute than appreciated and are going to be with us for a longer period,” House says.

“We are seeing areas where there’s going to be ongoing inflation pressure even after we get past some of those acute price hikes in a handful of sectors.”

The danger of groupthink: “There is a new fear circulating inside the West Wing of the White House: Maybe Larry Summers was right.” https://t.co/dodInIMDvJ

— Josh Kraushaar (@HotlineJosh) July 13, 2021

RELATED: TX Gov. Abbott Vows To Arrest Democrats Who Fled State, Haul Them Back To The Capitol

Huge Uncertainties

Even liberal Former Clinton Treasury Secretary Larry Summers has been warning that President Biden’s lavish-spending agenda was creating the risk of a spike in inflation.

In an interview with Politico, Summers explains that his concerns have only grown.

“These figures and labor market tightness and the behavior of housing markets and asset prices are all rising in a more concerning way than I worried about a few months ago,” he said.

[totalpoll id=”234787″]

“This raises my degree of concern about an economic overheating scenario.”

Summers though does contend that there are “huge uncertainties” going forward, which could sway results.

BREAKING: Democrats To Ram $3.5T Biden Agenda Through Senate Without Bipartisan Support As Inflation Skyrockets https://t.co/gSV1dNqxQb pic.twitter.com/zZt5qcYFIy

— The Daily Wire (@realDailyWire) July 14, 2021

Despite these inflation indicators, Democrats stand poised to ram through a partisan $3.5 trillion spending bill that will “enact the full array of President Joe Biden’s social welfare” agenda.

Unfortunately for American workers, if nothing changes rising prices are “here to stay for years” according to economists surveyed by The Wall Street Journal.

The different ways Biden’s hidden tax of rising prices is hitting your pocketbook. https://t.co/GqZBHtG5Wd

— RNC Research (@RNCResearch) July 13, 2021

The Republican National Committee has labeled inflation a “hidden tax” brought to you by the President with more almost certainly on the way.

“On Biden’s watch, the money in your pocket is worth less and less – that’s the Democrats’ hidden tax on all Americans,” Tommy Pigott, Rapid Response Director for the RNC states.

Now is the time to support and share the sources you trust.

The Political Insider ranks #16 on Feedspot’s “Top 70 Conservative Political Blogs, Websites & Influencers in 2021.”