By John Tamny for RealClearMarkets

It’s often asked if Congress will “end the Fed.” The answer to the previous question is obvious, but not for the reasons readers may think.

Congress will never shutter the Fed is because the central bank is ultimately an outsourced institution of Congress. Does anyone seriously think Congress would cease propping up insolvent banks, regulating banks, and vainly trying to make credit “easy” if the Fed shut its doors?

The questions answer themselves. Life without the Fed would be the same as life with it.

RELATED: Elizabeth Warren Introduces Bill To Nearly Triple The IRS Budget

Furthermore, Congress needs a whipping boy. So do presidents. Even though the Fed’s economic influence is well overstated either way, politicians need someone to blame when economies shrink. The Fed is forever. Bank on it.

These basic truths are worth remembering when it comes to the Internal Revenue Service (IRS). To call for “ending the IRS” is to kind of miss the point. More on this in a bit.

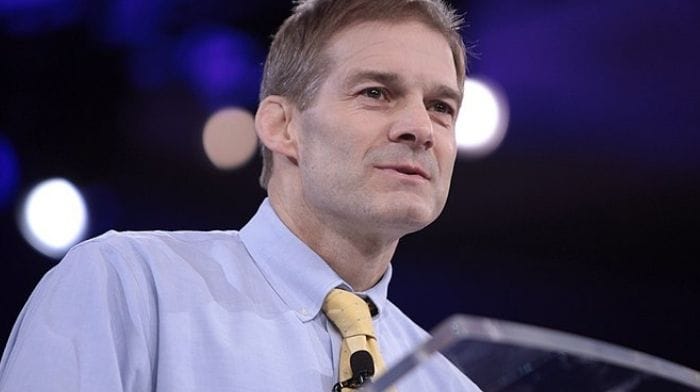

For now, we have to accept life as it is. The IRS isn’t going anywhere, and since it isn’t, readers should loudly encourage Reps. Jim Jordan and Darrell Issa in their probe of the IRS. More specifically, they’re looking into how the private tax returns of very rich Americans were leaked to ProPublica, and from there to the public.

What happened was beyond shameful. That it was illegal similarly misses the point. Figure that there are many illegal acts that aren’t shameful.

In this case, certain Americans did their taxes and filed them confident that their filings would remain confidential. The IRS violated the expectation of confidentiality with its leaks. The violations are unacceptable.

Few things are more personal than income, and the idea of an entity that at least nominally exists to serve us is leaking our personal information is truly offensive. It quite simply shouldn’t happen. The review of tax documents should be designed so that it cannot happen.

To make sure what shouldn’t happen again doesn’t happen again, changes should be made so that document review is wholly blind. Ideally such a change will be part of the conclusions of the Jordan/Issa probe.

Still, for now we have to live with the world as it is. Even if “blind” precautions are made, human nature is just that. Taxes will be filed, and somewhere along the way someone within the IRS is going to have knowledge of how the superrich, superpolitical, or both filed and paid their taxes. And what’s confidential may no longer be.

So while the result of the Jordan/Issa probe will hopefully be that some or many are fined and jailed, that justice will be done will not change human nature. As long as there are rich people with high profiles, and so long as some are rich and political at the same time, we now know that they’re at risk for the alleged sin of being rich and political. Please think about what this means.

Really, how many of the well-to-do among us will start pulling punches, or cease their support of various causes, if only to not get on the wrong side of the IRS?

RELATED: GOP Lawmakers Warn IRS May Tax Churches After Rejecting Tax-Exempt Status To Christian Non-Profit

While the rich most often get that way by expertly improving our living standards through the creation of can’t-live-without products and services, their broader involvement in politics is their way of doing even more than they’ve already done.

Call people like Charles Koch, Peter Thiel and the late Sheldon Adelson public benefactors in addition to the amazing things they do commercially for the public. Let’s say the same about major Democratic donors like Ron Burkle, Michael Bloomberg, and Jim Simons.

But will people like the three mentioned continue to involve themselves in politics and policy, and continue to support the “wrong” candidates if the reward is having their personal information leaked by the highly political within the IRS?

To the previous question, some on the Right will reasonably respond that the Jordan/Issa probe is particularly important to them given the not unreasonable speculation that the IRS’s leaks were meant to aid the Biden administration in its attempts to raise taxes on “the rich.”

Supposedly the revelation that Jeff Bezos “only” paid taxes in the billions over a specific timeframe would bring out the proverbial pitchfork in us all on the way to tax increases. The assumptions are fair.

At the same time, who’s to say an IRS overseen by a Republican presidential administration won’t in the future leak the tax filings of rich or political Democratic critics? Didn’t President Nixon have an enemies list?

It’s all a loud reminder that the Jordan/Issa probe should be bipartisan. The IRS quite simply should not be leaking confidential information. Period. Catch those who did leak what’s confidential, and prosecute them to the maximum extent possible.

Still, let’s never forget the real problem. It’s one of human nature. What’s confidential is valuable. Combine the latter with the politicized nature of everything in modern times, and it’s naïve to assume what was shameful won’t happen again. Which speaks to the value of scrapping the income tax altogether in favor of a levy on consumption.

As citizens of a country founded on freedom, we shouldn’t have to “prove” our income to anyone in the federal government. End the income tax, and there’s less likelihood of the indefensible happening again.

Except that it’s unrealistic to expect the scrapping of the income tax, and for obvious reasons. Politicians want to eat too, and they want to retire in splendor. In that case, an incomprehensible tax code is the best friend of the political class. The more intrusive the better.

Lots of money can be made lobbying small changes to what’s incomprehensible in “retirement” from politics. The income tax is similarly forever.

So is the IRS. An outsourced institution of Congress, politicians will never get rid of what does the distasteful collecting for them. Which is why the Jordan/Issa probe is so important. If the IRS is forever, an example must be made of those who abused its power.

Jim Jordan and Darell Issa are doing essential work, and should be cheered for doing it.

Syndicated with permission from RealClearWire.